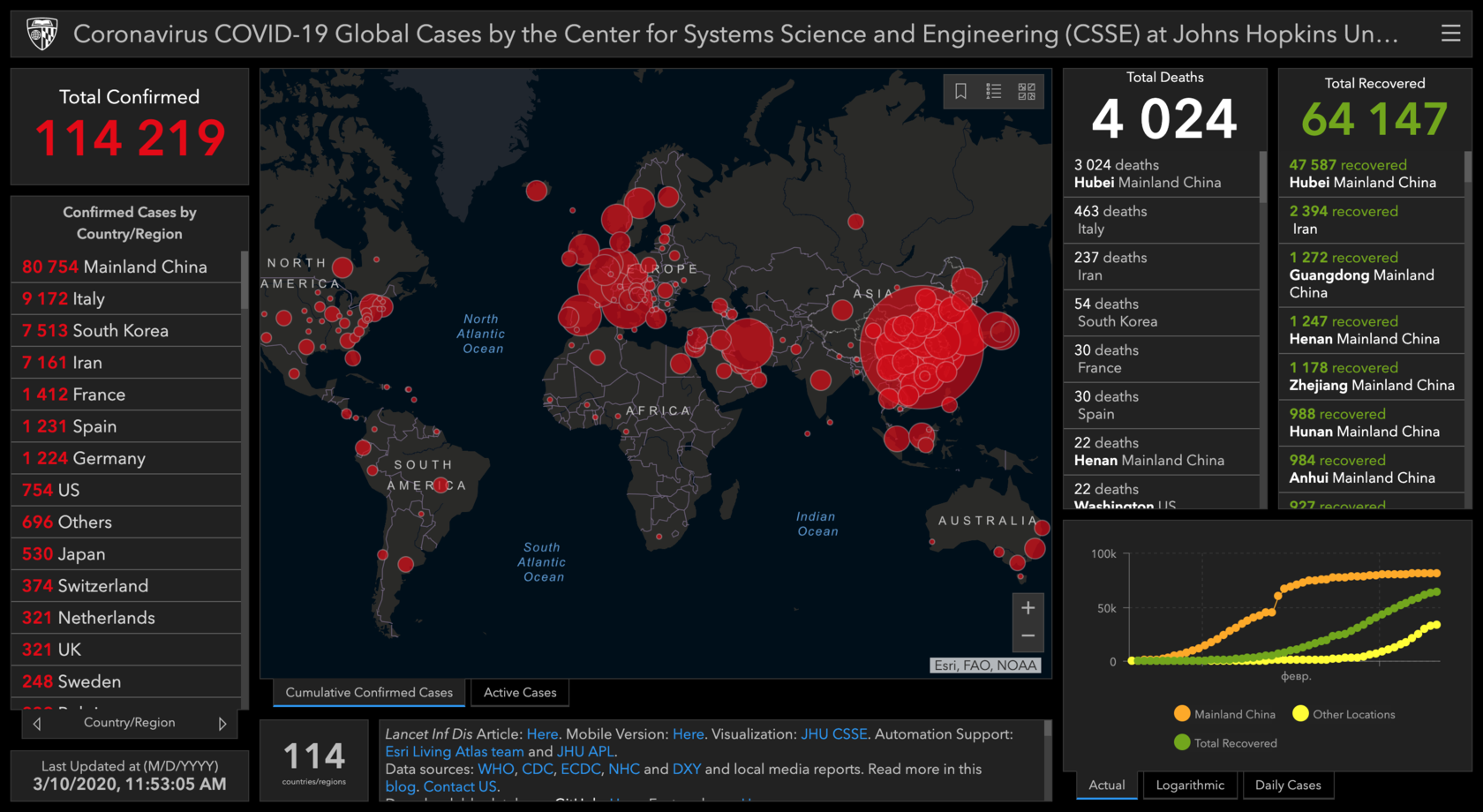

An outbreak of coronavirus since the beginning of 2020 has already led to a slowdown in global economic growth. According to Oxford Economics, global GDP may decline by $1.1 trillion (1.3%) in 2020, in which case a recession will begin in the US and Eurozone economies.

Since the beginning of 2020, amid the spread of coronavirus, airlines around the world began to cut the route network, freeze investment and hiring. And the authorities of some countries notified airlines and tour operators about the entry ban for citizens of countries where the coronavirus was most active.

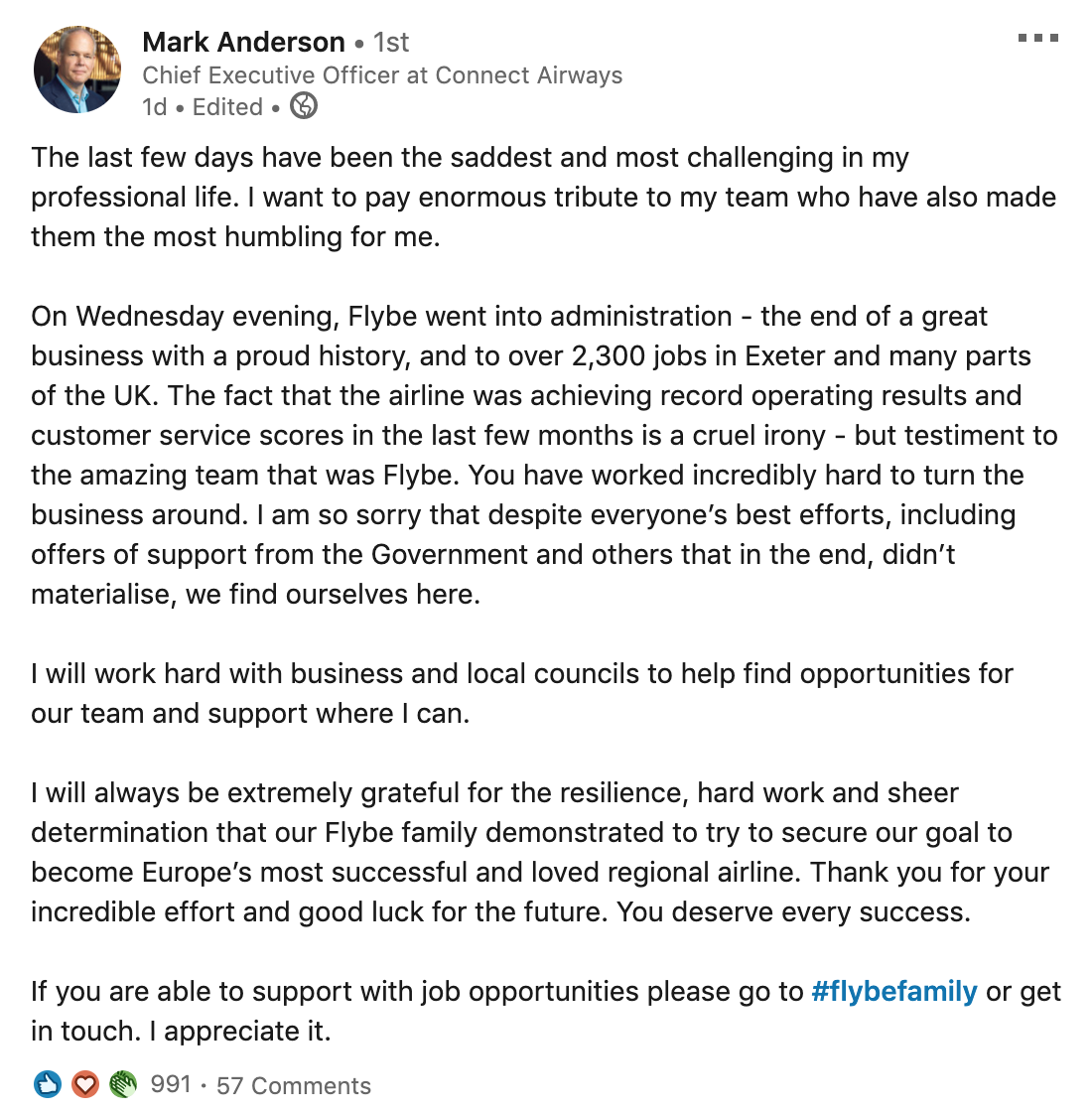

The disruption of supply chains and the decline in trade since the beginning of the year led to the departure of several freight carriers, such as the British CargoLogicAir and the Slovak ACG. Among passenger airlines, the first victim was the regional British company Flybe, which had long hung in the balance from bankruptcy.

The International Air Transport Association (IATA) estimated the reduction in airline traffic due to the virus outbreak at $63 billion. If the spread of the virus cannot be controlled, the losses will quadruple the initial estimate and reach $113 billion. Losses of the tourism industry in the EU alone can amount to more than 10 billion euros, this will inevitably lead to bankruptcies among tourism operators.

Many airlines so far do without reducing ticket prices, and reducing the route network allows them to cut costs in order to compensate for part of the losses from the fall in revenue.

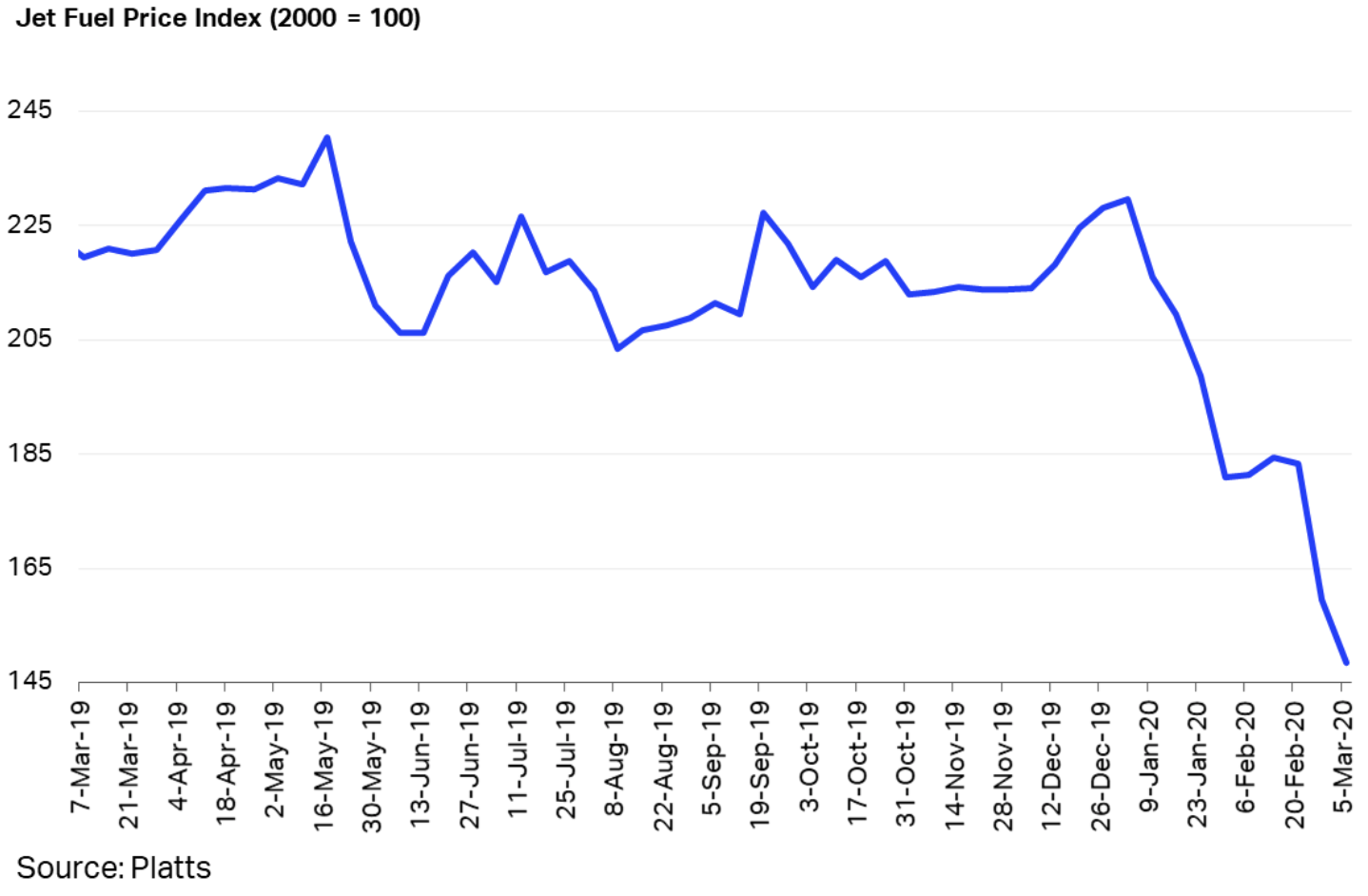

A significant drop in oil prices and, consequently, on jet fuel will allow airlines to reduce costs and improve the balance of payments, and also use purchases hedge - that is, actually pay bills for jet fuel for the year ahead.

The higher the price of crude oil, the higher the cost of new aircraft created on the basis of new technological solutions. That is why a decrease in fuel prices will be associated with a higher credit risk for those investors who are inclined to buy a new generation of aircraft. Thus, a fall in oil prices will certainly lead to an increase in demand, and, accordingly, the cost of reliable older generation aircraft. All this can adversely affect the development of production programs for high-fuel-efficiency aircraft of the Boeing 737 MAX or Airbus A320neo family and lead to lower prices.

Thus, a drop in oil prices increases the investment attractiveness of older aircraft, and their reliability will allow airlines to partially compensate for losses in 2020 due to the consequences of an epidemiological threat.

Evgeny Mitelev, CEO